Ginny Murray and her husband, Chaz, plan to drop their health insurance due to rising premiums that are expected to double or triple by January. They believe saving the money previously spent on insurance is preferable, betting on their savings for any unforeseen medical issues. This decision is part of a larger trend as enhanced subsidies from the Affordable Care Act (ACA) are set to expire, potentially leaving around 4 million Americans uninsured next year.

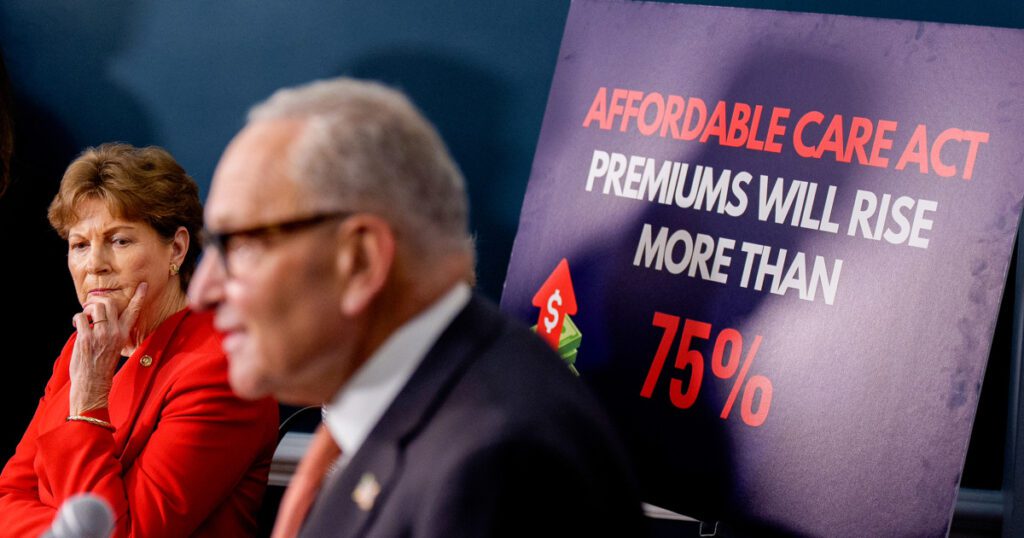

Experts warn that the upcoming premium hikes, estimated at 26% in their state, will force many to reconsider their health insurance options. Historically, millions have risked going uninsured with dire economic consequences. While the ACA significantly reduced the uninsured rate from 16% to 7.7%, the financial burden of unexpected medical expenses remains a concern for many.

Other individuals, like Denver residents Donnell and Christopher Dowis, and New York photographer Claire Esparros, share similar fears and frustration about increasing costs. Dowis and her husband plan to save money instead of maintaining coverage, despite the potential risks, while Esparros is considering a medical co-op to reduce her costs.

Experts suggest that self-insurance models could offer a cheaper alternative but carry their own risks, as they are not regulated under the ACA. Overall, the looming premium increases and subsidy expirations are creating a precarious situation for many Americans regarding their health insurance choices.

Source link