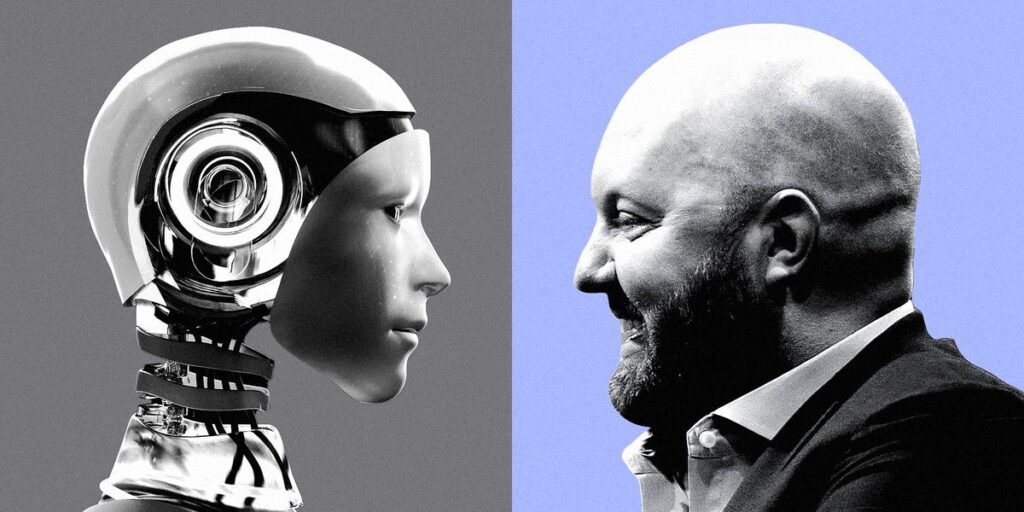

Marc Andreessen, a renowned venture capitalist and co-founder of Andreessen Horowitz, is a staunch advocate for artificial intelligence (AI), describing it as a transformative tool likened to “the stone of the philosopher.” He believes that while AI can streamline many tasks, the role of a venture capitalist (VC) is likely irreplaceable due to the required human intuition, creativity, and collaboration involved in selecting and nurturing startups.

In a recent podcast, Andreessen emphasized that despite the rise of AI, the essence of venture capital remains a unique art, not a science. He challenged the AI community to demonstrate its investment capabilities but reiterated that identifying winning ventures requires human insight that AI lacks. While some evidence suggests AI may be delivering better business advice to executives, Andreessen argues that the intrinsic, intuitive nature of venture funding cannot be replicated by machines.

Critics point out that Andreessen’s views may overlook the changing landscape, where AI could democratize investment decisions by evaluating startups on merit rather than traditional biases. Moreover, the effectiveness of AI in predicting successful business trajectories remains debated.

Ultimately, while Andreessen maintains that AI cannot fully replace the human elements of venture capital, the evolving capabilities of AI challenge the status quo and necessitate a reevaluation of the VC role.

Source link