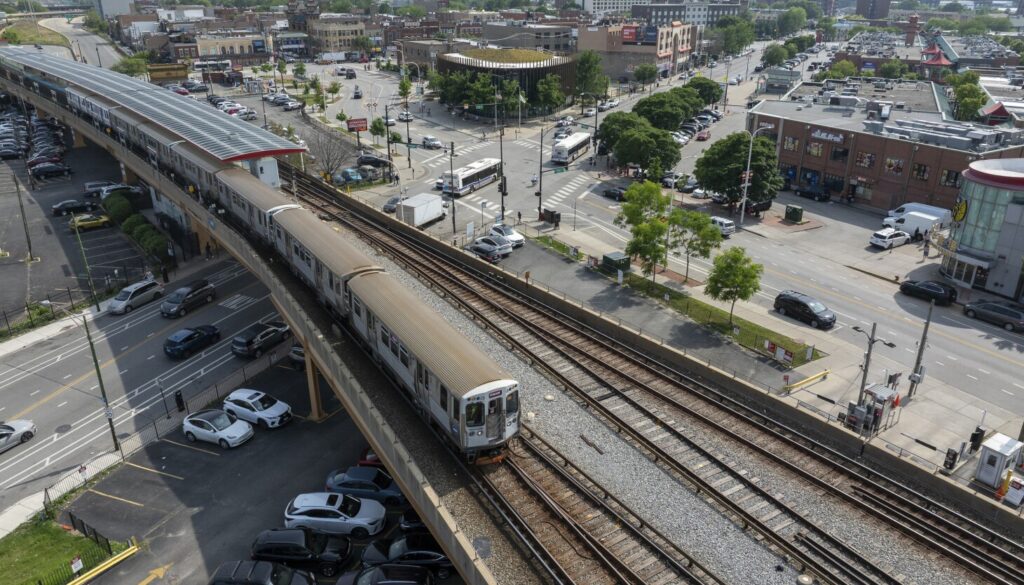

State lawmakers in Illinois finalized a transportation bill early Friday to support Chicago’s transit agencies, avoiding a potential $200 million fiscal cliff next year. A successful 2 a.m. House vote and 4 a.m. Senate vote led to a $1.5 billion funding plan that eliminates a rejected statewide tax proposal, focusing instead on new revenue sources.

Key components of the bill include:

– Directing state sales tax on motor fuel to transportation projects, potentially generating $860 million annually.

– Allocating interest from the state’s $8 billion road fund for transit, bringing in nearly $200 million per year.

– Allowing the Regional Transit Authority to increase sales tax by 0.25%.

– Maintaining current public transportation fares for a year while increasing car fares by 45 cents and other vehicle costs by 30%.

– Establishing a new board with a 15-vote threshold to replace the Regional Transit Authority by June 1, 2026.

Notably, the amended bill dropped proposals for a 7% streaming tax and a “billionaire tax” on unrealized capital gains, surprising some lawmakers who felt it favored Chicago too heavily.

Transit and labor leaders pushed for this resolution amidst concerns over service cuts due to declining ridership post-COVID-19. The transit agency also warned of a nearly $800 million budget deficit by 2027 without further state funding.

In related legislative actions, lawmakers also passed a bill aimed at restricting federal immigration authorities from deportations near hospitals and other public places, which is expected to face legal challenges. State Senate President Don Harmon and other proponents emphasized the bill’s commitment to protecting community rights.

Source link