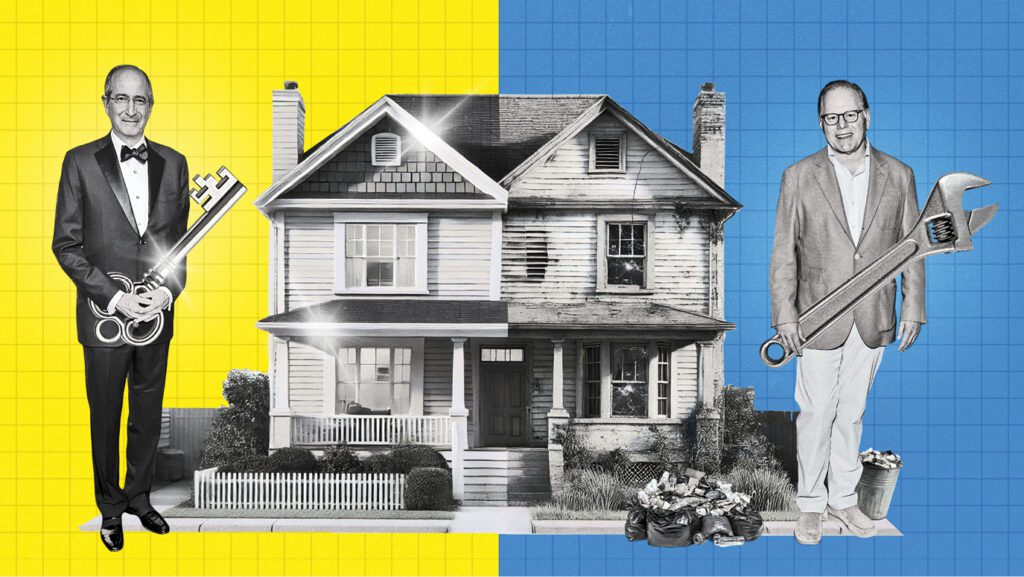

The article discusses the formation of Warner Bros Discovery (WBD) and the subsequent challenges it faces. Initially sparked by friendly communications between CEOs David Zaslav and John Stankey in 2021, the merger was viewed optimistically. However, three years later, employees express dissatisfaction amid fears of budget cuts, even as executive salaries rise.

WBD’s significant $30 billion liabilities are in stark contrast to Comcast’s Bersant, which operates with minimal debt, raising concerns about WBD’s stability and acquisition appeal. Analysts question the viability of traditional media channels in a streaming-dominated landscape, noting that Zaslav’s studios might struggle without cash flow from cable.

The economic differences between WBD and competitors like NBCUniversal highlight WBD’s reliance on declining cable revenues. While there could be opportunities for acquisitions in WBD, analysts predict a significant reduction in its global network. Comparisons with other companies show a more focused approach from competitors, which may be better positioned for future growth.

Overall, the piece reflects a media industry increasingly driven by financial metrics, raising doubts about the sustainability of traditional cable models and the strategic direction of companies like WBD.

Source link