Morgan Stanley has highlighted several stocks poised for success heading into 2026, including Nvidia, Spotify, Western Digital, and Palo Alto Networks, all rated with "Overweight" status.

Spotify: Analyst Benjamin Swinburne emphasizes that Spotify is thriving, driven by its AI capabilities and growth in audio streaming and podcasts. He sees an opportunity to leverage AI as a positive force for the company and expects its stock price to rise by 30% in 2025.

Palo Alto Networks: Analyst Meta Marshall identifies cybersecurity firms as key players for 2026. The price target for Palo Alto has been raised to $245 from $228, as its current valuation is appealing. Marshall is optimistic about the company’s growth prospects, particularly with its upcoming acquisition of CyberArk.

Western Digital: Analyst Eric Woodring notes that Western Digital is capitalizing on the healthy HDD market, with several upcoming catalysts like its Innovation Bazaar and quarterly results. The price target for its stock has increased from $188 to $228, reflecting strong demand and robust pricing power.

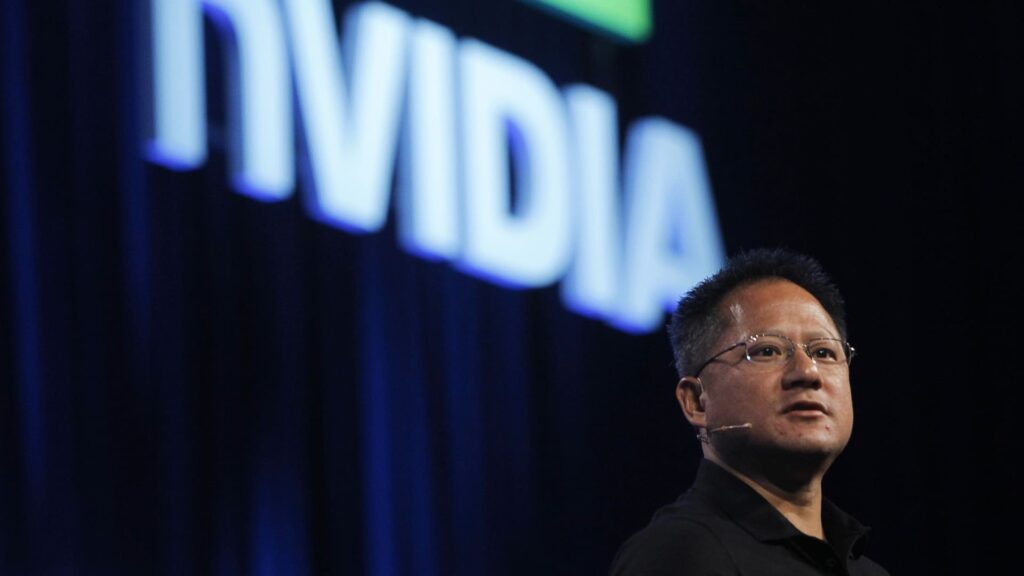

Nvidia: Described as central to the AI industry, Nvidia continues to exceed sales expectations significantly. The company is expected to benefit from the growing demand for AI, reinforcing its strong market position.

Overall, Morgan Stanley’s analysts are bullish on these companies due to their evolving strategies and strong market fundamentals, anticipating substantial stock price increases in the near future.