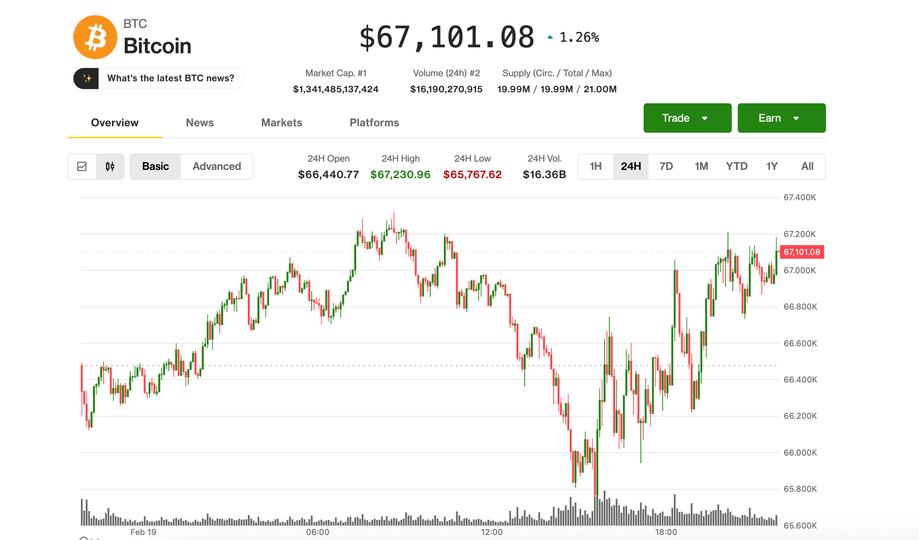

Bitcoin (BTC) briefly dipped below $66,000 but later stabilized around $67,000, rising about 1% in 24 hours. Other cryptocurrencies like Ether (ETH) and XRP showed modest movements, while Solana (SOL) remained flat, indicating caution in the altcoin market amidst volatility. Crypto stocks, particularly miners like CleanSpark and Marathon, saw a 6% rise, contrasting with slight declines in the S&P 500 and Nasdaq 100.

On the regulatory front, discussions are ongoing regarding the Digital Asset Market Structure Bill, showing tentative progress but lacking a clear compromise. Meanwhile, issues linger from recent downturns in the crypto market. For instance, Blockfills, a Chicago-based crypto lender, is considering a sale after halting customer transactions following significant loan losses.

Investors remain wary, recalling events from 2022, yet the market has not experienced a complete crash akin to scenarios like Celsius or FTX. Concerns outside the crypto realm, such as credit market stresses and geopolitical tensions, are contributing to this cautious sentiment. Private equity firm Blue Owl’s restrictions on its credit fund further intensified fears, leading to declines in share prices of major credit management companies.

In the derivatives market, traders are adopting defensive strategies, buying downside protection while limiting upside participation. With many Bitcoin ETF investors experiencing average paper losses of 20%, caution persists, although ETF holdings remain relatively stable compared to peaks.

Source link