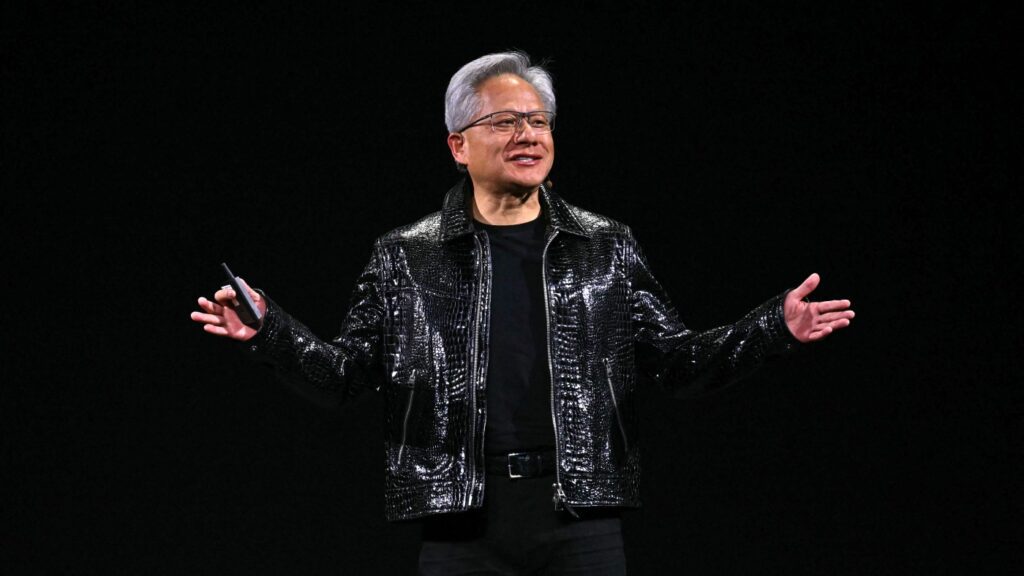

Nvidia CEO Jensen Huang will keynot at CES in January, embodying the AI boom that has seen Nvidia’s value surge 300% over the past two years. Huang addressed investor concerns about an AI bubble during an earnings call, emphasizing a long-term growth perspective. Other figures, including White House AI advisor David Sachs and Silicon Valley investor Ben Horowitz, expressed optimism about AI’s demand, dismissing bubble fears.

Contrarily, some experts, like Paul Kedrowski, argue that the rapid influx of capital into AI is speculative, noting stagnation in technological advancements. Companies like OpenAI are making substantial investments—$1.4 trillion over eight years—dependent on continued sales growth, which is uncertain as many companies find little impact from AI technologies.

Big Tech is anticipated to spend around $400 billion on AI this year, financed heavily through debt, which raises concerns about potential overbuilding and future financial crises. Analysts highlight the risks of cyclical trading practices that could inflate demand artificially and fear that if companies overinvest without a genuine market need, a crash could mirror the dot-com bubble burst.

Investor skepticism is emerging, as prominent figures like Peter Thiel are liquidating Nvidia stock. Executives, including OpenAI’s Sam Altman and Google’s Sundar Pichai, acknowledge excessive investor enthusiasm and potential irrationality in the current AI market, suggesting that no company would be immune if a bubble were to burst.

Source link