The article discusses expectations surrounding U.S. Treasury yields and Federal Reserve (Fed) interest rate decisions. Anticipation is that the Fed will maintain the six-month Treasury yield at its current level in December. As inflation accelerates, the challenge of lowering interest rates becomes complex, particularly affecting the bond market.

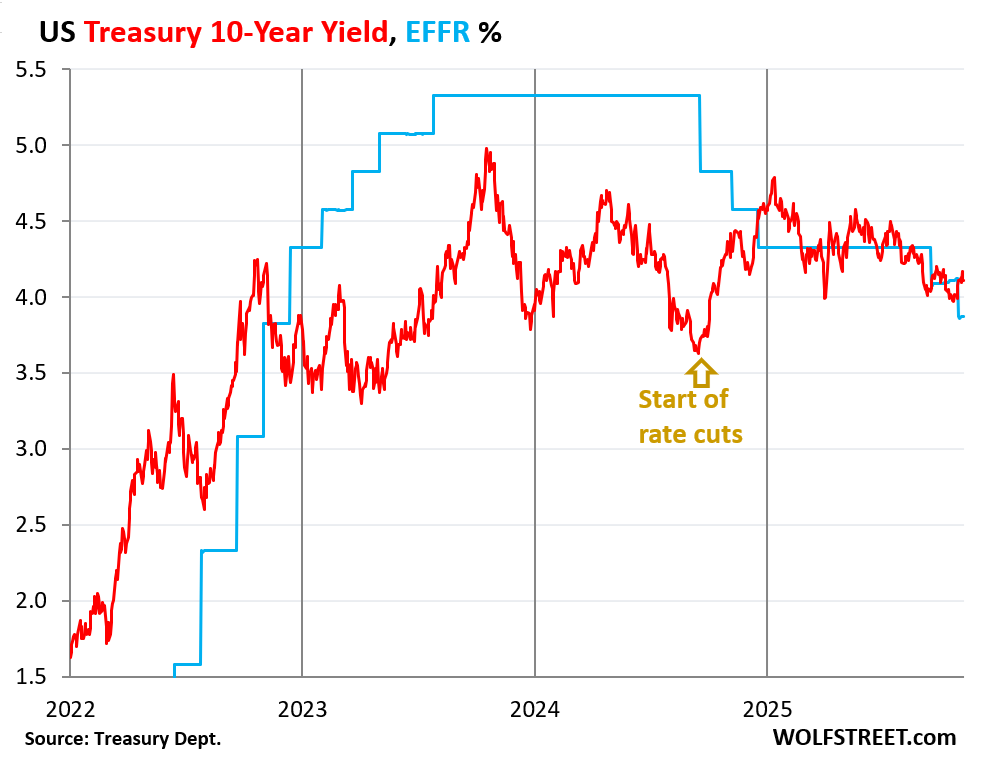

The 10-year Treasury yield recently hit 4.11%, marking a significant increase since the Fed’s policy cut in October and previously in September 2024. The 30-year Treasury yield also rose to 4.70%. Despite the Fed’s interest rate cuts totaling 150 basis points, long-term yields have risen due to market concerns about inflation and government borrowing.

The current effective federal funds rate (EFFR) is now around 3.87%. Longer-term yields, like the 10-year Treasury, tend to exceed short-term rates, leading to an “inverted” yield curve. Overall, the yield curve has been rising since the Fed’s last rate cut, reflecting bond market predictions.

Mortgage interest rates have increased alongside Treasury yields, reaching 6.32%. This is particularly concerning given the sharp rise in home prices over the past few years, exacerbated by the Fed’s monetary policies.

Market expectations suggest that the Fed will keep rates stable in December, as the six-month yield currently aligns with the EFFR’s target range, indicating that the market is prioritizing inflation concerns and potential future bond supply over immediate Fed policy changes.

Source link