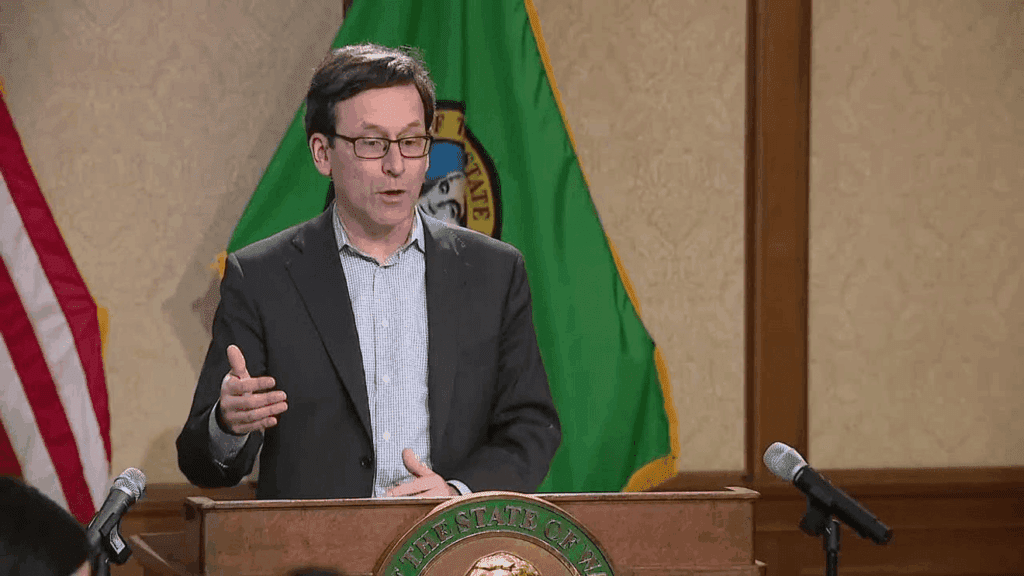

Olympia, WA—The millionaire tax bill has advanced through the state Senate with a 27-22 vote and is now headed to the House, prompting discussion about significant amendments before potential signing by Governor Bob Ferguson. Ferguson emphasized the need for the bill to benefit Washington families and small businesses amid the state’s affordability crisis, asserting he opposes any income tax on individuals earning less than $1 million.

He supports a 9.9% tax on incomes over $1 million but insists on revenue-sharing strategies. Proposed changes include directing around $1 billion for small business tax breaks, expanding sales tax exemptions for essentials, and implementing semi-annual sales tax holidays for items priced under $1,000. Ferguson also called for an enhancement of the Working Families Tax Credit.

When asked about a potential veto if substantial changes aren’t made, Ferguson avoided specifics but reiterated his firm stance on necessary adjustments. Critics argue that the tax could drive high-income earners and businesses away from Washington, a claim Ferguson dismisses as lacking evidence. Conversely, Colin Hathaway, a local business leader, argues that tax policies are influencing relocations, highlighting a growing concern about the business climate in the state.

The legislative process continues, with both chambers needing to finalize the bill by March 12. Ferguson reiterated, “Our north star… is to make life more affordable for more Washingtonians.”

Source link