As Bitcoin’s value has sharply declined and Strategy Inc. (MSTR) stock has dropped nearly 70% from its peak, there are increasing calls for the company to be liquidated, raising concerns about its financial stability. Throughout 2025, MSTR has relied on perpetual preferred stock to finance Bitcoin purchases, mainly using at-the-market (ATM) common stock sales to meet preferred dividend obligations.

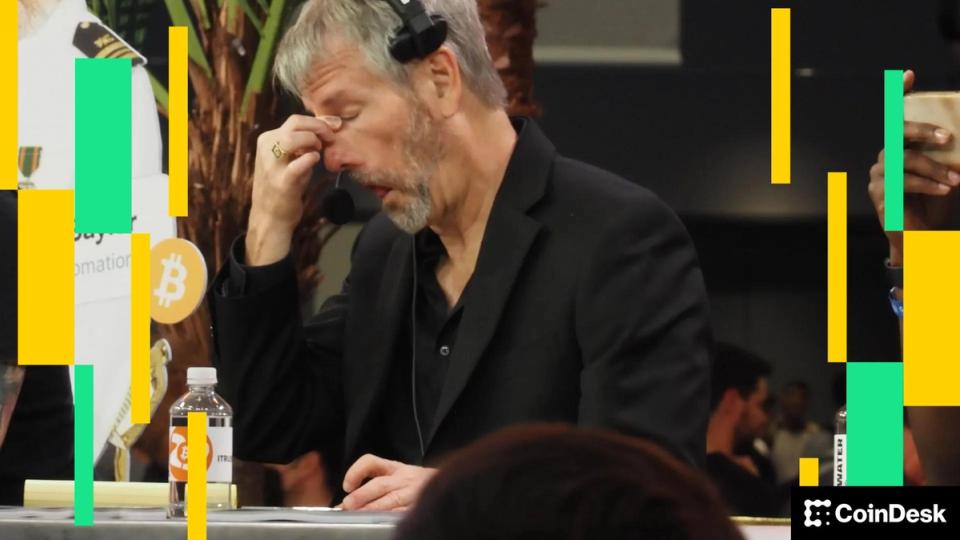

The company, led by Michael Saylor, issued four series of US-listed preferred stocks this year. The first series, STRK, offers an 8% fixed dividend, convertible to common stock at $1,000 per share. STRF, with a 10% fixed non-cumulative dividend, is performing well, trading around $94, while STRD has underperformed at approximately $66.

As Bitcoin’s value approaches a critical level of $74,400—where MSTR’s holdings are currently losing value—concerns about a potential sell-off arise. However, a significant structural pressure point will occur in September 2027 when holders of a $1 billion convertible note will be able to convert it to cash, contingent on the company’s stock performance.

Despite current challenges, MSTR can still cover its preferred dividend obligations through options like issuing more common stock, selling Bitcoin, or paying dividends in new shares. However, these measures may diminish investor confidence and impede future funding efforts for further Bitcoin acquisitions.

Source link