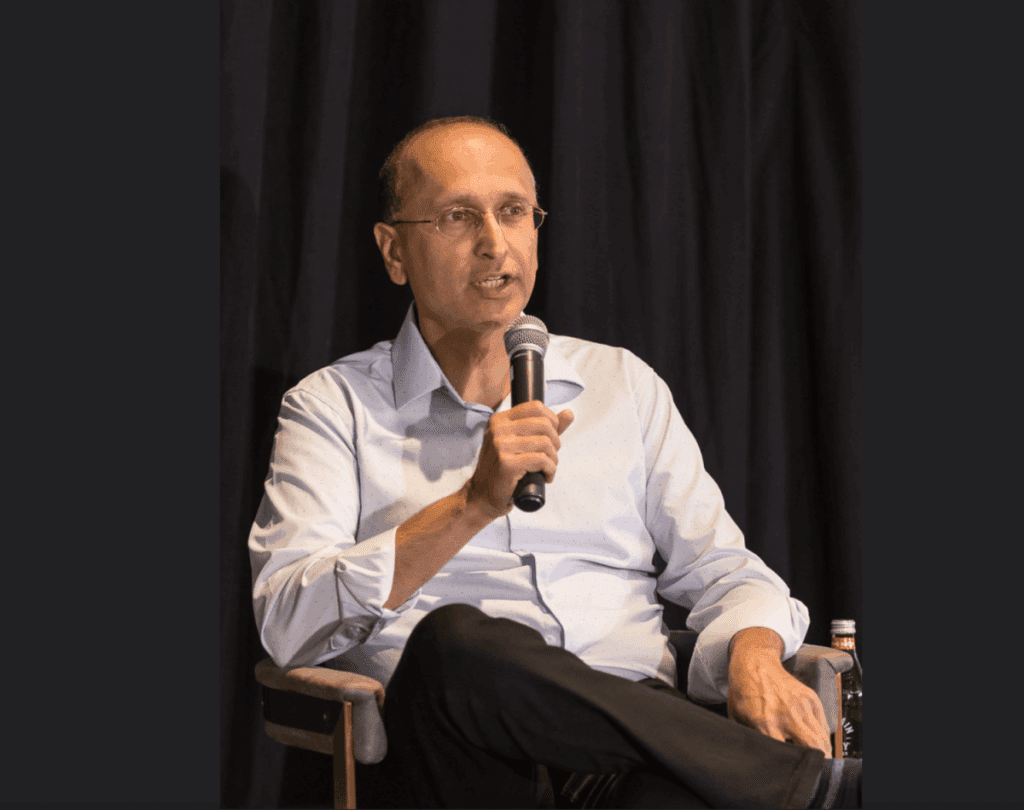

Navinchada, the managing director of Mayfield, emphasizes AI’s potential to transform heavy industries like consulting, law, and accounting. He argues that AI can help these sectors operate with software-like margins, evidenced by significant shifts in technology over the decades, from mainframes to today’s AI.

He asserts that AI will reduce human labor in repetitive tasks and suggests two growth models: organic and inorganic. For example, Gruve, an AI tech consulting startup, demonstrates how AI can enhance security services by reducing reliance on human staff, adopting a results-based pricing model instead of traditional hourly billing.

Navinchada discusses the “innovator’s dilemma” faced by companies like McKinsey and Accenture, which may struggle to adapt their business models to AI-driven, outcome-based revenue systems. Small companies leveraging AI, which don’t currently compete with these giants, will challenge them in the future.

Despite potential job displacement due to AI, he remains optimistic, comparing it to past technological disruptions that ultimately expanded markets rather than eliminated jobs. He believes that innovation often leads to new opportunities, even as the transition period may be painful.

Investment strategies in this evolving market rely on experienced investors who understand long-term trends rather than succumbing to fear of missing out. Navinchada concludes that while this cycle could generate significant profits, the majority of investors may not succeed if they lack strategic insight.

Source link